This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Leveraging quality Accounts Receivable for a specialty metal fabricator

Situation

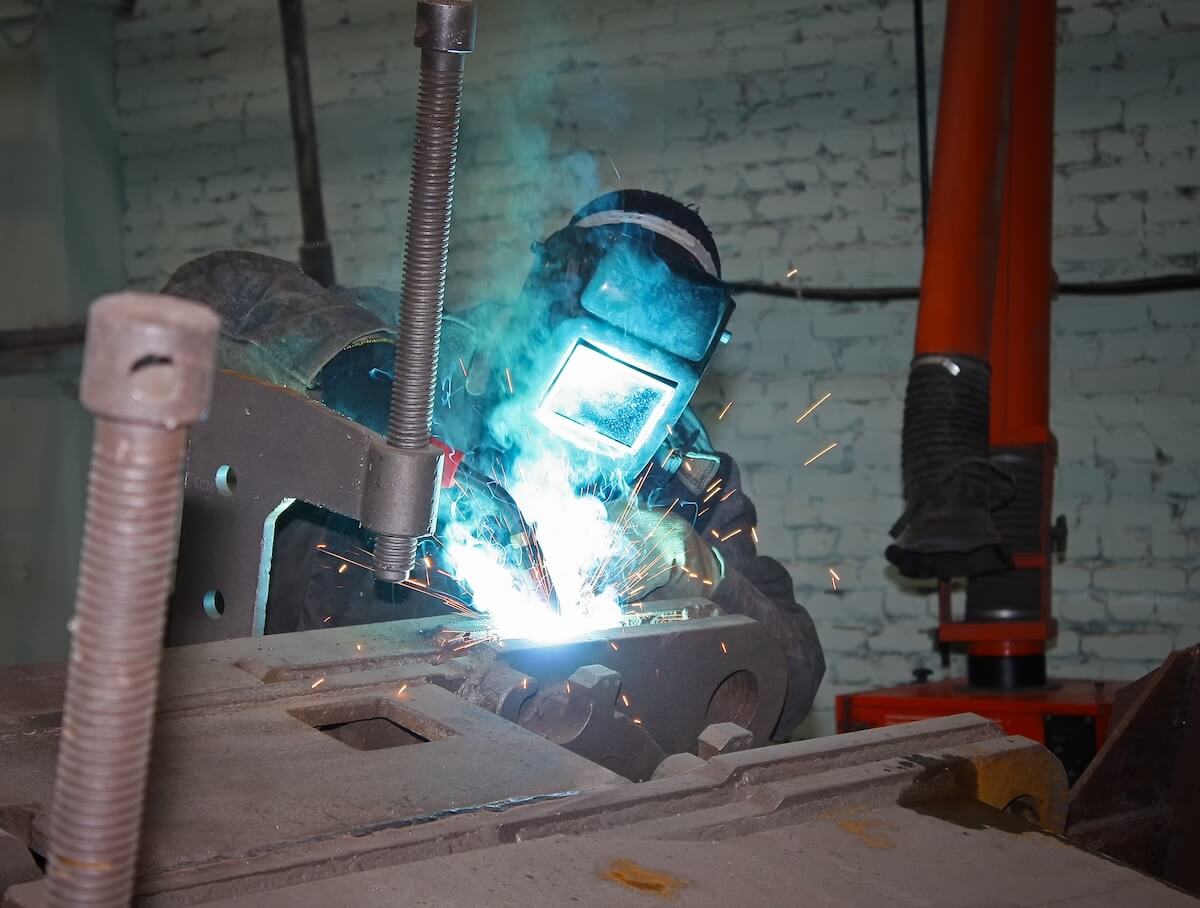

Formed in 2017, this small business provides specialty metal fabrication and other welding services to a variety of customers across North and South Carolina. With a focus on customer relationships, the owner developed a strong reputation in the market for providing quality work at a reasonable price. The company had previously secured a $100,000 bank line of credit but needed a larger line to support their continued growth. The owner approached his local bank for an increase to the line of credit but was turned down due to a lack of cash flow. Instead of simply telling his customer “No,” the lender referred the company to Magnolia Financial.

Solution

Although the most recent tax return showed limited cash flow that would not support a larger bank line of credit, Magnolia Financial focused its credit decision on the company’s quality Accounts Receivable. Within 24 hours of the initial meeting, Magnolia proposed a $350,000 Accounts Receivable Line of Credit. The proceeds from the Magnolia Financial credit facility was used to payout the existing bank line and also provided additional working capital. The company now has sufficient liquidity to support its growth plan and expects to return to profitability within 6 – 12 months. The bank was not only able to keep the deposit relationship but will look to take back the line of credit sometime next year.