This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

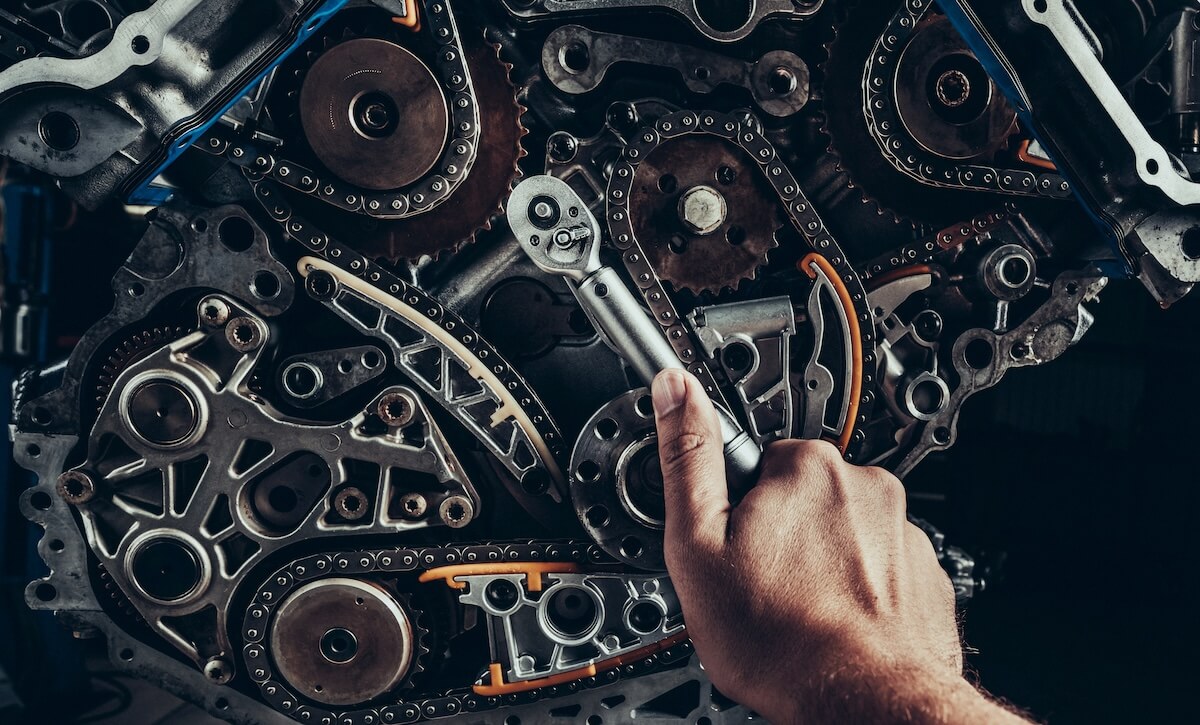

Turning up capacity for a machine part repair company

Situation

Formed almost 20 years ago, this small, family-owned business specializes in electric motor repair and outsourced machine shop services for a variety of local companies. With a strong but small customer base, the company enjoyed a solid reputation for top-notch service at a reasonable price. However, due to cash flow constraints, the company periodically had to turn away new customers. In order to try to grow the company, the owner approached their local bank for a working capital line of credit. Due to limited profits and a deficit net worth from excessive distributions, their bank was unable to approve the request. However, in order to provide an alternative solution, the banker referred the company to Magnolia Financial.

Solution

Instead of focusing on the financial statements, Magnolia understood the value of the company’s customer relationships and the opportunity for growth. Within 24 hours of the initial introduction, Magnolia proposed a $150,000 Accounts Receivable Line of Credit. With the working capital provided by Magnolia Financial, the company added two new shop workers to increase capacity. The owner no longer has to turn away new business and is projecting record profits for the year. Neither would have been possible without the working capital provided by Magnolia Financial